APA Style

Alexander Voronov. (2025). On the Added Value Conception for the Implementation Instruments Towards Sustainability of the Markets with Carbon Risk. Sustainable Processes Connect, 1 (Article ID: 0015). https://doi.org/10.69709/SusProc.2025.172912MLA Style

Alexander Voronov. "On the Added Value Conception for the Implementation Instruments Towards Sustainability of the Markets with Carbon Risk". Sustainable Processes Connect, vol. 1, 2025, Article ID: 0015, https://doi.org/10.69709/SusProc.2025.172912.Chicago Style

Alexander Voronov. 2025. "On the Added Value Conception for the Implementation Instruments Towards Sustainability of the Markets with Carbon Risk." Sustainable Processes Connect 1 (2025): 0015. https://doi.org/10.69709/SusProc.2025.172912.

ACCESS

Research Article

ACCESS

Research Article

Volume 1, Article ID: 2025.0015

Alexander Voronov

Voronov.a@unecon.ru

International Centre for Information and Analytics, Faculty of Management, Saint Petersburg State University of Economics, Saint Petersburg 191023, Russia

Received: 22 Feb 2025 Accepted: 22 Sep 2025 Available Online: 23 Sep 2025 Published: 30 Oct 2025

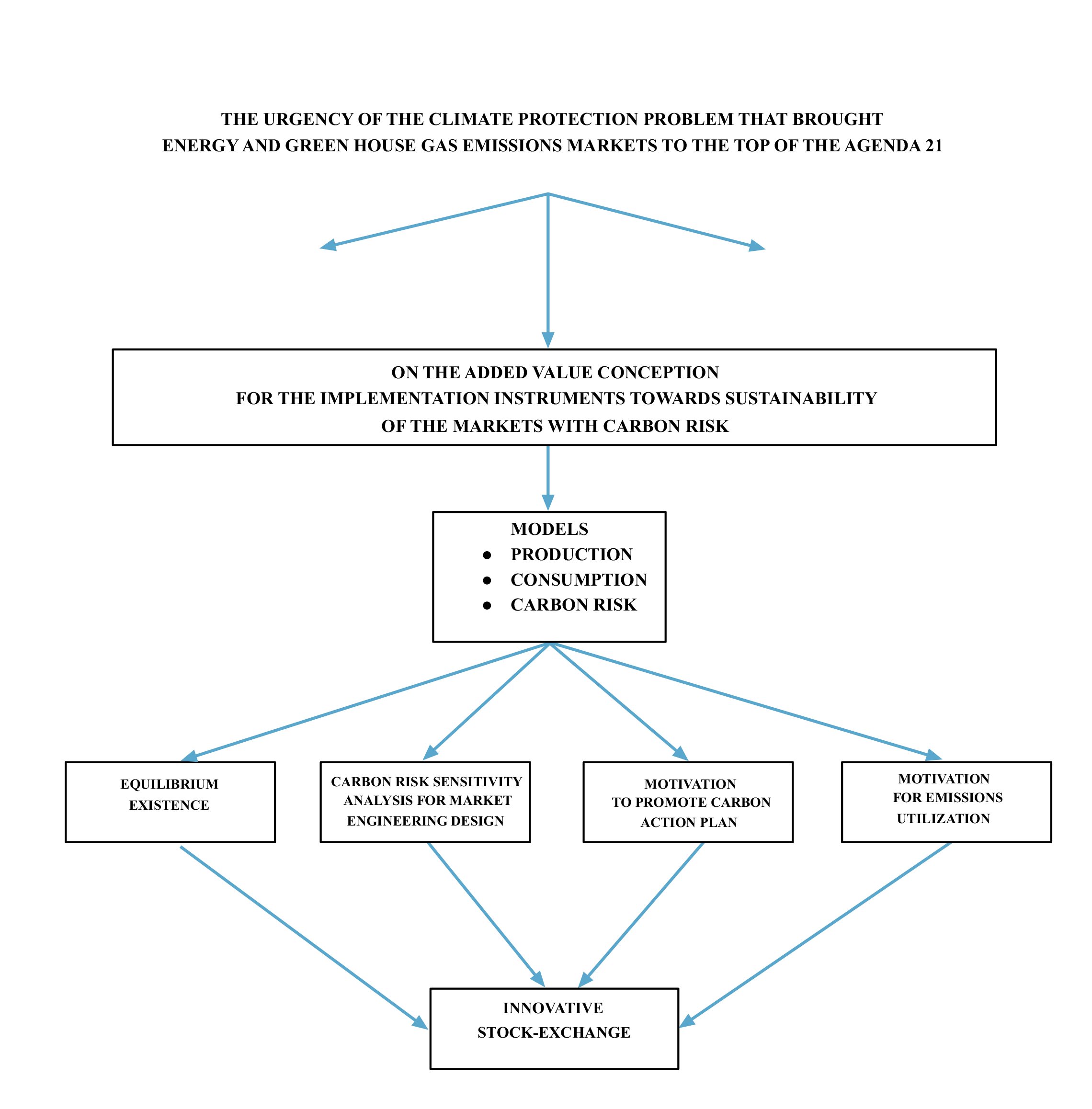

The key component in achieving efficient carbon management, which involves balancing the mitigation of carbon dioxide emissions with the application of carbon dioxide utilization technologies, is the implementation of market sustainability. A value-added model serves as the basis for assessing carbon risk. This study have undertaken multi-criteria modeling for the analytical approximation of the product life cycle, based on a wide range of parameters for control and optimization, including: (1) the quantitative assessments of the market balance for products with carbon risk; (2) the quantitative framework for carbon risk sensitivity analysis; (3) the conditions for motivating production and consumption participants to promote sustainability; (4) relationship between waste utilization costs and technology efficiency as a motivator for minimizing carbon dioxide emissions; (5) innovative stock exchange according to sustainability criteria. The practical prospects for sustainability management of products with carbon risk, including those in energy markets, are examined using the vector optimization technique, while the quantitative indicators presented provide market participants with a strong basis for decision-making in environmental management. The proposed model approach (carbon risk, managed market, innovative stock exchange) introduces novel approaches for environmental management under sustainability criteria.

The quantitative assessments for the balance existence in the market of products with carbon risk The quantitative scheme for carbon risk sensitivity analysis The conditions for production and consumption participants are the motivation to promote sustainability The relationship between waste utilization costs and technology efficiency is the motivation for carbon emissions minimization The functional diagram of the innovative stock exchange operating under the sustainability criteria

The urgency of climate protection has placed energy and greenhouse gas (GHG) emissions markets at the forefront of the Agenda 21 frameworks. The new agenda focuses on the creation and development of energy markets. An important component is the development of models that facilitate the adaptation of market mechanisms toward a low-carbon economy. These models are aimed at reducing greenhouse gas emissions. These measures will enable the establishment of an economic development system based on low energy consumption. At the same time, market mechanisms are considered today in the broader context of energy system management, which requires the development of the theory and practice of market engineering design. Therefore, it is necessary to consider relevant implementation tools based on Life Cycle Assessment (LCA) and Market Engineering Design (MED), which are applicable to products with carbon risk (CR) [1,2]. Currently, the International Organization for Standardization (ISO), which oversees standardization in organizational management, production, and technology, is planning to publish the first international standard on ‘net zero’ in 2025. The standard will be based on the ISO guidelines agreed in 2022 during COP27 [3]. These guidelines contain the main recommendations for inclusion in the draft standard, reviewed as comprehensive study of greenhouse gas emissions to develop ways to reduce them; consideration of appropriate localized emissions, taking into account their usefulness at the local level; the priority given to states where carbon removal exceeds greenhouse gas emissions; development of low-waste and closed-loop technologies; the prioritization of decision-making based on reliable knowledge and management experience. From the perspective of the concept of sustainable development, the decision to turn the guidelines into a full-fledged “net zero” standard was driven by the need to involve more participants at the international and local levels in setting reliable targets for reducing greenhouse gas emissions that can be confirmed in practice. It is well recognized that ISO standards provide essential guidance and support, and ISO already oversees numerous standards related to energy, circularity, and environmental management. Therefore, ISO’s work should proceed in parallel with prospective scientific research, grounded in modeling and supported by market engineering design [4]. The new energy agenda undertakes the utilization of carbon dioxide, which is divided into three main areas: carbonation of minerals for the production of building materials, chemical conversion for the production of chemicals and fuels, and biological conversion for the production of chemicals and fuels. In addition, a well-established design for carbon footprint reduction in the energy sector involves a higher penetration of renewable energy resources. Large-scale minimization of carbon dioxide emissions requires fundamental breakthroughs in the development of technological processes and the creation of an economic system that promotes the practical implementation of the new agenda [5,6,7]. Solving these new tasks requires the involvement of interdisciplinary knowledge. In this regard, LCA is a generally accepted approach for qualitative and quantitative modeling of complex economic processes related to greenhouse gas emissions [8]. The stages of the LCA should be conducted with consideration of economic, social, and environmental factors, forming a systematic perspective on sustainability for the practical implementation of the new agenda [9,10]. Thus, the LCA system boundary determines which elements of the product life cycle are considered in this analysis. The system boundaries may encompass both the energy generation facility and the processes of carbon dioxide release associated with the production of the target product. This approach makes it possible to account for variations in CO₂ emissions and other factors, depending on the technologies associated with carbon-risk product markets. These models can be used as the basis for cost calculations that affect the goals and tools of technology improvement. GHG utilization is a relatively new technological challenge and is still in the early stages of implementation. Thus, the development of prototypes of both technologies and methods of their quantitative assessment for implementation in commercial markets is an urgent task. At the same time, LCA will help to optimize the sustainability performance of promising energy systems at an early stage of technological development. Such studies will enable the identification of key tasks required for the commercial-scale utilization of carbon [10,11]. In turn, the task class, the representative of which is the theme under discussion, has developed the concept and methods for assessing the sustainability of the product life cycle. This involves an assessment of the sustainability of the product life cycle—the resource stage, the production stage, the use stage, and the disposal stage. The functional structure of this concept is recognized as a system-level approach, and achieving progress among the activities contributes to improving their well-being, environmental safety, and economic efficiency [12]. The use of market instruments will contribute to the efficient allocation of resources in many areas of the functioning of promising energy systems [13]. In this context, MED models and methods play a crucial role in ensuring energy security and supporting the transition toward a more sustainable energy supply within economic systems under the new agenda. Engineering design and market engineering are closely related concepts. Today, market design is considered as an object or as an activity. Market design is a tool for creating an effective market. Our interpretation of MED combines the design and organization of economic facilities, where the supply and demand of economic products (goods, services, technologies) are realized and can be bought and sold [14]. The complexity of the energy sector and its high importance for a competitive economy require the use of models and practical calculation schemes that can provide an adequate picture of the new economic systems being created [15]. Such tools serve as valuable engineering software for the analysis and design of emerging market systems [16,17]. Thus, applied market models form the basis of engineering design for evaluating conclusions in solving complex organizational and technological problems. Thus, one of the key theoretical tasks in market modeling is the optimal mechanism for allocating resources for existing commercial activities [18,19]. An increasing number of companies identify inclusion in the Dow Jones Sustainability Indices as a corporate objective. These companies publicly endorse their approach to addressing sustainable and proactive long-term opportunities. Such practices also make these companies more attractive to investors. This activity creates vibrant competition among companies for index membership. Each year, over 3000 publicly traded companies, including about 800 companies in emerging markets, are invited to participate in the Corporate Sustainability Assessment. Given the potential of exchanges to contribute to economic development, it is important not only to enhance the understanding of their role and functioning, but also to foster environments that support the development of well-functioning exchanges aligned with sustainability objectives [20]. Based on the above, the ‘innovative stock-exchange process’ is considered here as an iterative approximation with distributed calculations toward market equilibrium, incorporating sustainability criteria. Currently, much attention is being paid to the problem of GHG emission reduction in developing countries. Research and development cooperation promotes the integration of external knowledge, facilitates information exchange, and fosters regional innovation and development. At the same time, technological innovations can encourage enterprises to abandon backward processes, use energy-saving technologies, form an environmentally friendly production chain, and reduce the intensity of carbon emissions. However, most of the literature on carbon dioxide emissions is devoted to individual countries. In developing countries, research on the relationship between economics, science, technology, and carbon dioxide emissions remains uncertain. Therefore, the choice of technological innovation and economic growth as the main variables of the study has important theoretical and practical significance [21]. Our research provides engineering tools to achieve a practical discussion of market goals that complement the traditional results of economic theory. In particular, the discussion focuses on complex products, consisting of the target product and the associated carbon dioxide emissions, that are intended for trade in carbon-risk markets. Simplicity is a key requirement for engineering design in this area of research. Another aspect of simplicity is the mass availability of engineering tools. Thus, this study is directed toward developing a market design that aligns with the existing sustainability concept and can be implemented within the current infrastructure. The developed market design tools would be a holistic overview of the requirements for functional market design and serve as a practical guide for market participants. In addition, these tools can serve as a foundation for structuring diverse perspectives, needs, and practical approaches. In this regard, the relevant user groups encompass a broad range of market stakeholders.

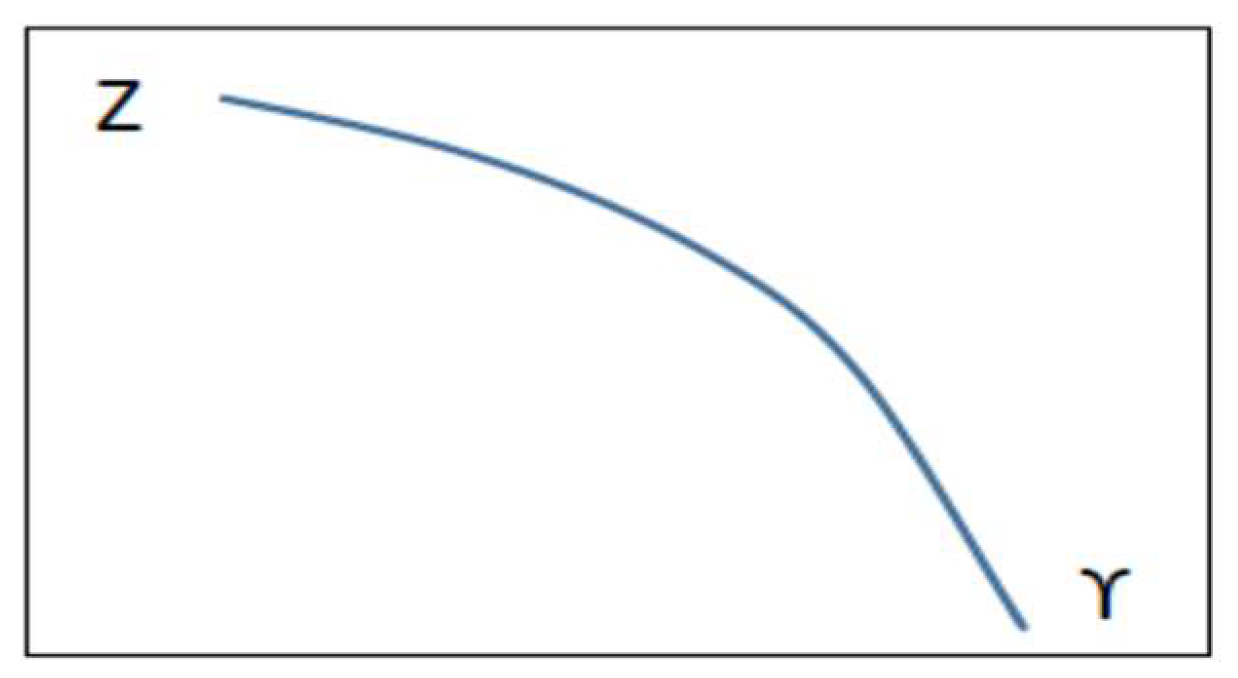

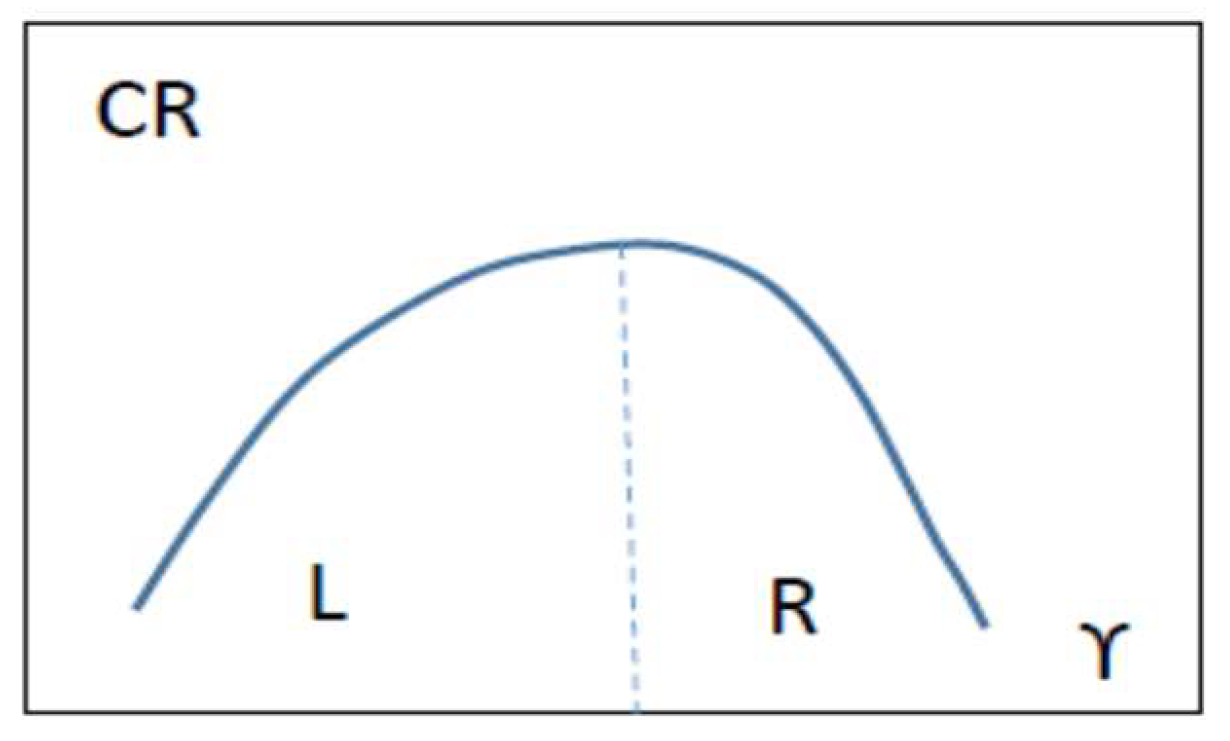

The state of scientific developments, despite their multiplicity, on the issues of sustainable development has not yet become a scientific theory in the strict sense of the word for a number of reasons. Firstly, the theoretical foundation of this area of scientific research remains underdeveloped, and it is not yet possible to speak of a sufficiently comprehensive and systematic theory as a structured form of scientific knowledge. Secondly, and most importantly, it is not yet possible to confirm the full reliability of existing theoretical constructions through practice, although some attempts at their mathematical formalization have been made. The development of analytical tools to establish and research market entities’ functional quality indicators is a key focus. Existing economic practice is primarily focused on analyzing market behavior, while the tasks of market design and management, owing to their extreme complexity, remain insufficiently explored. Such tasks involve an analytical consideration of the characteristics of a particular market that are adequate for the purposes of the study. The analysis of the equations of the product chain indicates the following statements [22]: There is an “economic” equivalent of the multi-criteria optimization problem according to the criteria W (wellbeing), S (safety), E (efficiency), based on the introduction of “total” cost functions (S) and utility functions (D). This circumstance determines the applicability of the “standard” economic tools (“costs and consumption”) to plan and analyze the activities of the resource transformation chain to solve the problems of product life cycle sustainability management. Consideration of environmental and social risks naturally affects the conditions for the existence of a competitive equilibrium in the resource transformation of the product life cycle. So, under the conditions of W, S, E-criteria, the permissible set of resource transformation becomes “narrower” and “shorter”. At the same time, the indicator of the sustainability quality as a degree (in another interpretation—probability) of compliance of the product’s resource cycle with the established and anticipated needs will decrease with increasing marginal risks. The applicability of these developments to market management tasks is largely determined by the practical implementation of the conditions of existence, uniqueness, and continuous dependence of market processes on manageable parameters. The formation of appropriate conditions and their practical interpretation remain the subject of research at present. In this regard, analytical models and methods are further considered, which, to a certain extent, are inferior to the generality of well-known classical approaches, but allow us to offer effective tools convenient for the tasks of quality management of product lifecycle sustainability. The analysis of the life cycle of a product with carbon risk allows us to introduce three types of objects [23,24]: (S) Production, characterized by the difference in income and costs of the manufacturer, QSi, 1 ≤ i ≤ I; (D) Consumption, characterized by the difference between the utility of the product and the cost of purchasing it, QDj; 1 ≤ i ≤ J; (C) Carbon pollution, characterized by the volume of carbon dioxide produced, CRi, 1 ≤ i ≤ I. The selected models enable the use of a generalized indicator of economic efficiency, incorporating total costs, and a specific indicator of environmental safety (carbon risk), which is based on a model of specific greenhouse gas emissions characterized by an inverse U-shaped Kuznets curve [24]. At the same time, a value-added model is used, which forms the basis for determining carbon risk in accordance with task No. 9.4 “A system of global indicators for Sustainable Development Goals and Targets of the 2030 Agenda for Sustainable Development” [25]. In this approach, indicator No. 9.4.1 “CO2 emissions on a unit of added value, γ” is applied. The task of market design is considered with respect to the introduced objects: This is a multi-criteria optimization problem, which is solved by maximizing the functional “L”: Here: qi, qj, gi are the normalizing constants of the corresponding dimension, and: Further, carbon pollution is proportional to value added: Here: AV is the Added Value, λ is the proportion of carbon dioxide produced, which is disposed of at a price φ per ton, and ϒ is the technology index. The producer’s income has the following distribution: Here: T = a∗K + A + M, AV = T (1 + b) + P − M, K—fixed assets, A—labor costs, M—materials costs, a—depreciation rate, b—overhead rate, c—income tax rate, d—value added tax rate. The solution to the optimization problem under consideration is the supply of “ui” and the demand of “vj” according to the condition (production function of Cobb-Douglas type is used with Z1—normalized outcome; K—capital; E—energy, A—labor; ρw and ρ—utilization and resource prices; θ, η, ϑ—inverse elasticity): And: Now, market design is the task of optimal selection for the production factors {θ, η, ϑ, Z1, K, E, ρ, ρw, λ, φ}, demand factors {ω, σ, ν} and tariffs {a, b, c, d}.

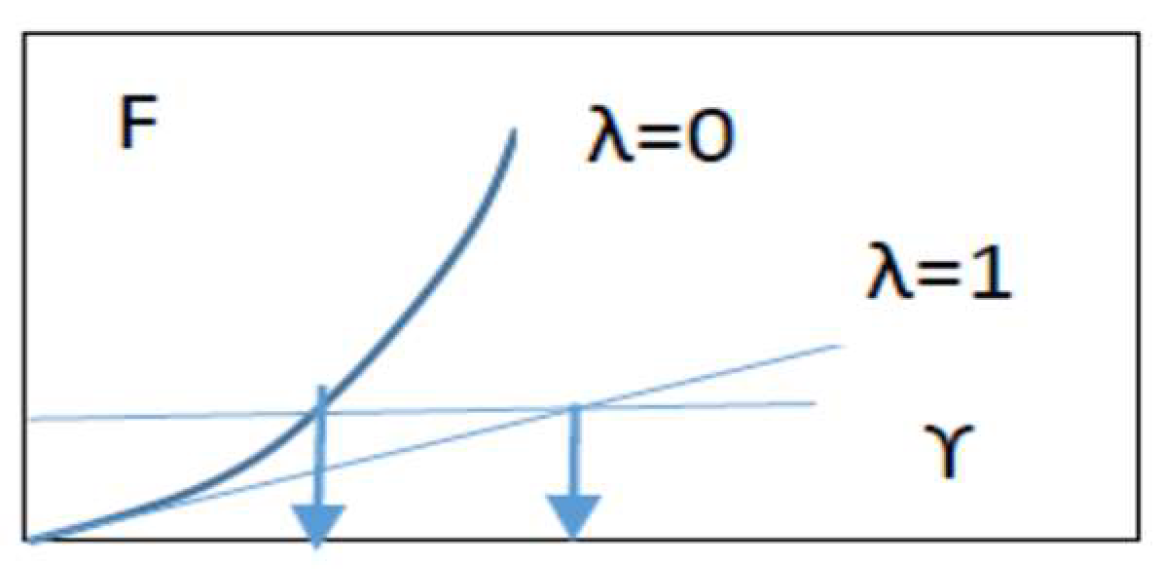

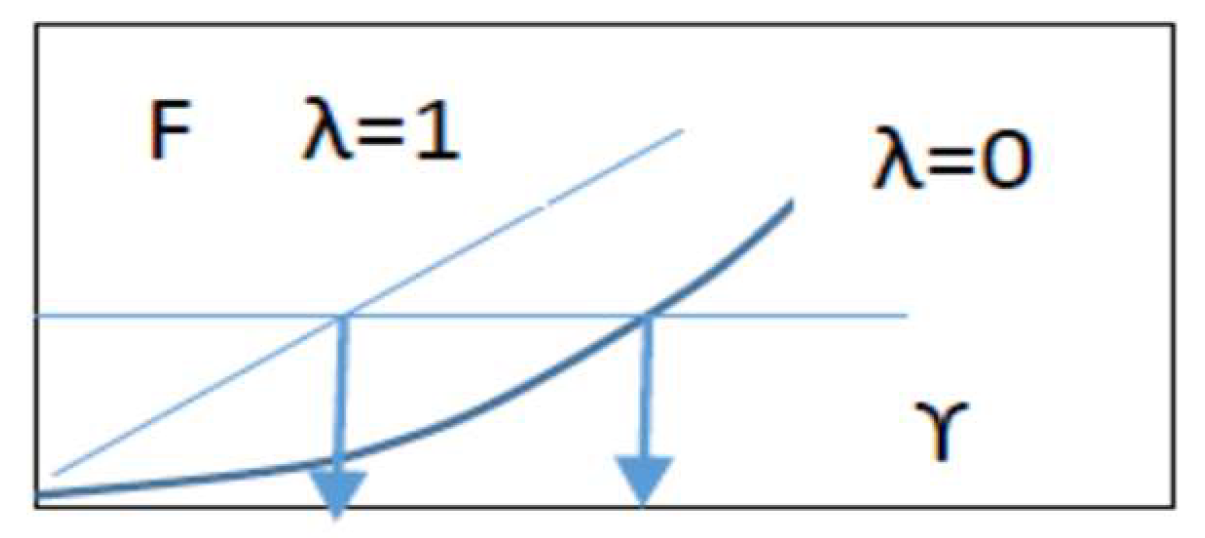

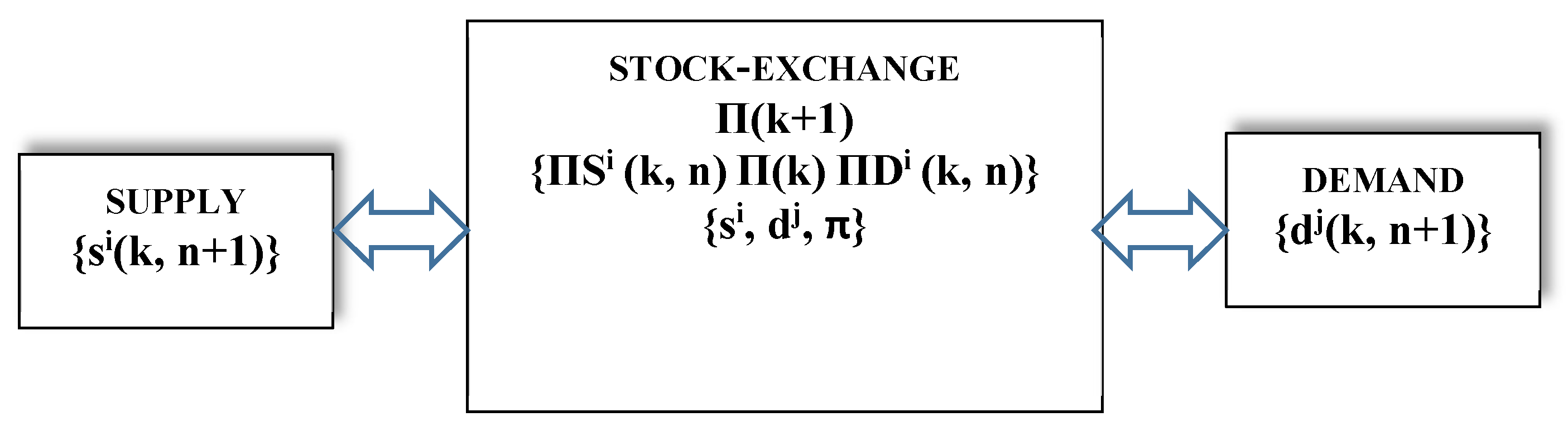

3.1. Equilibrium Existence First, the conditions for equilibrium existence are introduced in the proposition where production factors differ across producers, with K = var, E = var, and Z1 = var. According to equation (1), we have: Based at ui, we can find: Here is used A1: At the other hand: And: So, for the equilibrium point (Z, and Zmax if s = d) we have: The existence follows if, e.g., for θ > 1: It is seen that the condition (3) turns true while ρ↓ and s↓. 3.2. Carbon Risk Sensitivity Analysis for Market Engineering Design In view of MED promotion, it could be proposed the scheme, as it is introduced below. Let us have the following parameter set Δ = {θ, η, ζ, Z1, K, E, ρ, ρw, λ, φ, ν} that one is divided into Δ1 = {A1, θ, ρ, ρw} and Δ2 = {λ, φ, ν}. So, due to the equation (2), we can find the relation Z = Z (ϒ, Δ1, Δ2) with ∂ϒZ < 0, and ∂2ϒZ < 0 and ∂Δ1Z < 0 (i.e, A1↑→Z↓, θ↑→Z↓, ρ↑→Z↓, ρw↑→Z↓), refer to Figure 1: The parameter set Δ2 will be examined in the following section. At this stage, attention is focused on the relationship concerning Δ1: Also, we have: (*)—at the left side of the Kuznets Curve for CR, refer to Figure 2. Now, we can see that if the production side is looking for the implementation of CR↓, there is a need for A1↓. In the same way, one can find CR↓ if θ↑ is at the right side of CR (i.e., at the initial production stage). Also, at the initial production stage, we have CR↓ if ρ↑ and CR↓ if ρw↑ (i.e., production quality increases through more efficient waste utilization and the use of better resources). 3.3. Motivation to Promote Carbon Action Plan It is known that the quality of production objects follows an inverse U-shaped curve. So, in practice, it is not a fact that: In the other case, there is no incentive for the producer to exceed max {QS} in order to minimize CR, which follows an inverse U-type curve. It is observed that if ∂ZQS (Z = Zmax) > 0, then relation (4) holds. This establishes a sufficient condition for the stated motivation: And: The potential to increase ZC through parameter ρ is relatively limited, since Zmax exhibits a similar functionality. Therefore, it is necessary to identify demand factors that can enhance motivation within the carbon action plan. 3.4. Motivation for Greenhouse Gas Utilization As it is known, in the long term, effective management of the market for high-risk products is associated with the possibility of partial minimization of carbon dioxide (0 ≤ λ ≤ 1). Thus, the following pattern has been established: with an increase in the share of minimization (λ), both CR and QS decrease. In this case, there is a difference between the two cases: ν > φ. The case takes the diseases of utilization costs seriously; ν < φ. The case relates to high utilization costs. Consider the dependence of the additional tariff (F = s-d) of the value-added tax on the technological parameter F = F(ϒ), case (a) (Figure 3). If the additional tariff limit is fixed (corresponding to a constant value of the produced product), the technological parameter increases with a higher share of minimization (Figure 3): λ↑ → ϒ↑. Thus, with the increase in the share of CO2 minimization, the requirements for the quality of technology in terms of emission generation are decreased. Case (b), (Figure 4). In this case, with an increase in the share of minimization, the technological parameter will decrease: λ↑ → ϒ↓. Thus, with the increase in the share of GHG minimization, the requirements for the quality of technology in terms of emission generation are increasing. 3.5. Innovative Stock-Exchange with Criteria of Social Well-Being and Environmental Safety In rational exchange systems, when structuring a task, it is fundamentally necessary to remove part of the calculations related to socio-ecological aspects from the sphere of possible speculation, since they are conditioned by public interests and limit the possibilities of private benefit. Thus, in the exchange process under our consideration, two goals are pursued: (A) exclusion of control by market participants over the calculation of socio-environmental indicators and (B) minimization of the consequences of speculative behavior of market participants. The noted above problem “B” (minimizing the consequences of speculative behavior of market participants) is considered in the following context: let S and D set the “true” cost and utility functions at which true equilibrium {πo, Zo} is achieved. In practice, uncertainty information or a speculative substitution of S → S + ΔS can be implemented, where ΔS is a disturbance (including speculation), and similarly for demand. Then a new equilibrium {πo(Δ), Zo(Δ)} is realized and, if it provides a positive economic effect, then the parties will not be interested in trading with true costs and utilities, which is the essence of the fundamental “negative result” about the impossibility of implementing a market procedure that establishes the true equilibrium. However, taking into account risk functions allows minimizing the impact of speculation by the first order of disturbances. The object of the study is the indicators of changes in economic efficiency, ΔQ. If the perturbations have the order ΔS, ΔD ~ O(ε), then minimization of the value |∂εΔQ|ε=0 is achievable, and this ensures minimization of the impact of market uncertainties by the first order of disturbances. In the case of our discussion, there are existing {wi, wj, ni} such that we have: Therefore, participants in the carbon-risk market have no incentive for speculation, at least at the first order of disturbances. Another case yields a similar result when information uncertainty is present in the market. The aforementioned problem ‘A’ (the exclusion of market participants’ control over the calculation of socio-environmental indicators in the exchange process) can be addressed either jointly with task ‘B’ or independently. The corresponding procedure is based on a model for price dynamics in which, due to the properties of the cost and utility functions under WSE-sustainability conditions, there is a unique and stable equilibrium. The hybrid iterative exchange process then consists of two calculation circuits. The “outer” contour provides an approximation for the price vector. The internal circuit regulates socio-economic criteria and approximates the resource exchange vector using feedback from both supply and demand. For practice, a special case of the exchange trading model presented above is also interesting—an “auction”, when the supply side is represented by a fixed level of a product, for the purchase of which a limited number of competent buyers compete in terms of W, S, and E-criteria. The solution to problems ‘A’ and ‘B’ is based on analyzing the dynamics of resource exchange and the corresponding prices within the product chain. In this regard, exchanges perform a large number of important functions that contribute to the intensification of the circulation of global capital and international economic integration. The current stage of market development demonstrates that exchanges and exchange trading instruments have become integral to the economy, serving as key mechanisms for trade transactions without which the growth dynamics of the economic sphere cannot be sustained. Modern economic conditions are characterized by the growing need of commercial enterprises for specialists in the field of retail trade who are able to organize the integration of production and sales processes into exchange structures at a high level. In difficult economic conditions, bringing goods to market is not just a competitive advantage, but also the means of maintaining market positions. Based on the aforementioned features of the managed market, this study examines the algorithmic approach to the innovative stock exchange. Equilibrium existence and rational motivations conditions allow us to test the convergent process for W&S&E-sustainable participants of each stage at the regional product life cycle chain (resources, production, consumption, waste). Let π, si, dj—basic price, supply, and demand; Π(k), si(k, n), dj (k, n)—current price, supply, demand; for Π ≈ π and 1 ≤ i ≤ I, 1 ≤ j ≤ J, 0 ≤ k ≤ K − 1, 0 ≤ n ≤ N − 1 the principal scheme will be: Here is used: RΘ(V)—risk functions for stages of product chain, Θ = S or D: The noted algorithm is represented at Figure 5. In the case of (SΠi = const, DΠj = const), the exchange process determines the balance of supply and demand, taking into account the criteria of social well-being and environmental safety. In the case of (SΠi = var, DΠj = var), the exchange process additionally implements a mechanism to minimize the impact of market uncertainties in the first order of disturbances.

As mentioned above, the issue of greenhouse gas emissions is a fundamentally important component of the concept of sustainable development. The modeling of which assumes the establishment of a balance between three components of sustainability: economic efficiency, environmental safety, and social well-being. The practical prospects for sustainability management are examined through the vector optimization technique incorporating economic, environmental, and social objectives. Sustainable development claims to evaluate the effects of different sources of uncertainty in the markets. It is well known that the main assumptions of the market economy create incentives to disturb the basic equilibrium, for example, through speculative bargaining. So, the stability problem of sustainable development has been tested by the sensitivity conditions of the market criteria to the disturbances, including the stochastic ones. We consider the analytical formalization of this concept using a multi-criteria optimization toolkit. The undertaken model approach (carbon risk and its minimization assessment, managed market, innovative stock exchange), based on the life cycle thinking, is prospective to provide the analysis for sustainable development in the form of a stable mode along the equilibrium dynamics. Overall, three groups of criteria are considered in the simulated economic activity: economic efficiency (profit maximization), environmental safety (risk minimization), and social well-being (social risk minimization). The above-noted approach has provided a structure and algorithm for an innovative stock exchange operating with vector criteria. The latter could be well-suited to the international context, serving as a prospective instrument for advancing sustainability in developing countries. The chosen models allow us to operate with a generalized indicator of economic efficiency, which includes total costs, and a specific indicator of environmental safety (carbon risk), which is based on a model of specific greenhouse gas emissions. At the same time, a value-added model is used, which forms the basis for determining carbon risk. Technological innovations and a variety of social values constitute an additional set of tasks, which have required active and detailed engineering design of markets with carbon risk. At the same time, the multi-criteria modeling can provide several practical solutions, taking into account possible contradictions in the market.

It is quite natural that our work has its limitations. The considered set of market criteria is not exhaustive and is specifically adapted to the electricity market within the selected region. On the other hand, developers can extend our modeling to other details and cases of market design. In addition, the models are limited in their capacity to measure the proposed indicators. Thus, other developments may be aimed at establishing reliable quantitative indicators. We have also only outlined a tool for taking into account the relative importance of the introduced indicators. Further research may adapt the main results to a range of other markets, regions, and conditions. In particular, this applies to the problem of incorporating information uncertainty and vector criteria into the market economy within the context of a sustainable development strategy.

| AV | Added Value |

| COP | Conference of the Parties |

| CR | Carbon Risk |

| GHG | Greenhouse Gas |

| ISO | International Organization for Standardization |

| LCA | Life Cycle Assessment |

| MED | Market Engineering Design |

The sole author conceived and designed the study, conducted the literature review, performed the data collection and analysis, prepared the visualizations, interpreted the results, and wrote the manuscript. The author has read and approved the final version of the manuscript and is accountable for all aspects of the work.

Data supporting the results of the current study are available within the article.

No consent for publication is required, as the manuscript does not involve any individual personal data, images, videos, or other materials that would necessitate consent.

There are no conflicts of interest.

The study did not receive any external funding and was conducted using only institutional resources.

The author wishes to acknowledge Saint Petersburg State University of Economics for providing institutional support that contributed to the successful completion of this research.

[1] Guan, F.R. Insights from Behavioral Economics to Decrease Pollution and Reduce Energy Consumption. Low Carbon Econ. 2019, 10, 11–30. [CrossRef]

[2] Elegbede, O.; Emily, O.; Jolaosho, T.; Matti-Sanni, R.; Wuraola, O. Life Cycle Sustainability Assessment. In Encyclopedia of Sustainable Management; Springer: Cham, Switzerland, 2023. pp. 1–11. [CrossRef]

[3] The 27th UN Climate Change Conference (Conference of the Parties). 2022. Available online: https://news.un.org/en/events/cop27 (accessed on 22 February 2025).

[4] National Academies of Sciences, Engineering, and Medicine. Carbon Utilization Infrastructure, Markets, and Research and Development: A Final Report The National Academies Press: Washington, DC, USA, 2024. [CrossRef]

[5] Feng, D.; Yifei, H.; Bolin, Y. Peak Carbon Emissions in China: Status, Key Factors and Countermeasures. A Literature Review. Sustainability 2018, 10, 2895. [CrossRef]

[6] National Academies of Sciences, Engineering, and Medicine. Gaseous Carbon Waste Streams Utilization: Status and Research Needs The National Academies Press: Washington, DC, USA, 2019. [CrossRef]

[7] Wang, Y.; Guo, C.; Chen, X.; Jia, L.; Guo, X.; Chen, R.; Zhang, M.; Chen, Z.; Wang, H. Carbon Peak and Carbon Neutrality in China: Goals, Implementation Path and Prospects. China Geol. 2021, 4, 720–746. [CrossRef]

[8] Wanjing, C.D. Research on the Composite Index of the Modern Chinese Energy System. Sustainability 2019, 11, 150. [CrossRef]

[9] Traverso, M. Life Cycle Sustainability Assessment—A Survey Based Potential Future Development for Implementation and Interpretation. Sustainability 2021, 13, 13688. [CrossRef]

[10] NASEM, National Academies of Sciences, Engineering, and Medicine. Carbon Dioxide Utilization Markets and Infrastructure: Status and Opportunities: A First Report The National Academies Press: Washington, DC, USA, 2023. [CrossRef]

[11] Korevaar, G.; Tsalidis, G.; Kanat, N.; Harris, S. Report on the Life Cycle Sustainability Assessment. 2021. Available online: https://zerobrine.eu/wp-content/uploads/2021/12/D7.6-Report-on-the-life-cycle-sustainability-assessment-LCSA-results.pdf (accessed on 22 February 2025).

[12] Watróbski, J.; Jankowski, J.; Ziemba, P.; Karczmarczyk, A.; Magdalena Zioło, M. Generalized Framework for Multi-Criteria Method Selection. Omega 2019, 86, 107–124. [CrossRef]

[13] Gimpel, H. Market Engineering Springer Nature: Berlin/Heidelberg, Germany, 2021. [CrossRef]

[14] Sim, J.; Kim, B. Commitment to Environmental and Climate Change Sustainability under Competition. Sustainability 2019, 11, 2089. [CrossRef]

[15] Calder, J. The Calculus of Variations. University of Minnesota School of Mathematics. 2024. Available online: https://www-users.cse.umn.edu/~jwcalder/CalculusOfVariations.pdf (accessed on 22 February 2025).

[16] Peterson, K.; Ozili, P. Sustainability and Sustainable Development Research Around the World. Manag. Glob. Transit. 2022, 20, 259–293. [CrossRef]

[17] National Academies of Sciences, Engineering, and Medicine. Accelerating Decarbonization in the United States: Technology, Policy, and Societal Dimensions The National Academies Press: Washington, DC, USA, 2024. [CrossRef]

[18] Matthies, A.; Stamm, I.; Hirvilammi, T.; Narhi, K. Ecosocial Innovations and Their Capacity to Integrate Ecological, Economic and Social Sustainability Transition. Sustainability 2019, 11, 2107. [CrossRef]

[19] Mishra, M. The Kuznets Curve for the Sustainable Environment and Economic Growth. 2020. Available online: https://hdl.handle.net/10419/216734 (accessed on 22 February 2025).

[20] Sukumar, N. The Role of Stock Exchanges in Fostering Economic Growth and Sustainable Development. 2017. Available online: www.unctad.org (accessed on 22 February 2025).

[21] Zheng, J.; Mi, Z.; Coffman, D.M.; Shan, Y.; Guan, D.; Wang, S. The Slowdown in China’s Carbon Emissions Growth in the New Phase of Economic Development. One Earth 2019, 1, 240–253. [CrossRef]

[22] Voronov, A. Analytical Models and Methods for Quality Management at Sustainability of Product Life Cycle Scientific Electronic Library: Moscow, Russia, 2018. 265–270. Available online: https://elibrary.ru/item.asp?id=35399987

[23] Voronov, A. Life Cycle Approach for Sustainability Competence Assessment. In Sustainability Awareness and Green Information Technologies; Issa, T., Ed.; Springer: Berlin/Heidelberg, Germany, 2020. Chapter 2. [CrossRef]

[24] Voronov, A. Imagining on The New Development Concept of Life-Long Learning Towards Carbon Action Plan. Green Low-Carbon Econ. 2024 [CrossRef]

[25] SDG Indicators (Indicator 9.4.1: CO2 Emission per Unit of Value Added). Available online: https://unstats.un.org/sdgs/metadata/ (accessed on 22 February 2025).

We use cookies to improve your experience on our site. By continuing to use our site, you accept our use of cookies. Learn more